BaseFEX Review

If you are looking for crypto derivatives with leverage up to 100x, BaseFEX will be one of your best choices. The trading platform offers perpetual contracts in Bitcoin, Ethereum and several additional altcoins with the option to trade on margin. Be the cash settled Bitcoin futures or the Bitcoin denominated margins, BaseFEX will surely have a feature which you will find useful when trading with crypto.

Review Contents

- About the Company

- Trading Instruments on BaseFEX

- Crypto Futures and Perpetuals

- Margin Trading

- Available Order Types

- Deposits & Withdrawals

- Fees

- User Experience on BaseFEX

- Conclusion

Company background

BaseFEX is registered in the Seychelles Islands with registration number 205276. Although the administrative headquarter is in Seychelles, the operational center is in Hong Kong for BaseFEX. The company is in business since 2018.

The CEO of BaseFEX is Jesse Wu, a serial entrepreneur with in-depth experience in IT and forex trading. The CTO, Isaac Zeng has been working as a software engineer at Huobi crypto exchange before joining BaseFEX’s team.

The two individuals joined together to found BaseFEX in order to solve the problem that they were not able to find a reliable exchange to trade cryptocurrency derivatives. Their aim is to provide the best possible user experience with cutting-edge technology and expert support.

Trading Instruments on BaseFEX

Beyond Bitcoin, you can trade with 10 different altcoins at BaseFEX, including Ethereum, Ripple, and Litecoin. Here is the complete list of tradable coins on BaseFEX:

BTC, ETH, XRP, LTC, EOS, ADA, BNB, HT, OKB, ATOM.

Crypto Futures and Perpetuals

BaseFEX offers crypto derivatives including futures and spot trading with a high level of margin. All of the futures contracts, including the altcoins futures are settled directly in cash based on Bitcoin prices.

Futures is a derivative instrument where you can set the future price of the underlying coin at a present date. There is no cost involved in entering a futures contract at the beginning of the term, compared to options where you have to pay for an option underwriting fee. Still, futures can be a very useful instrument in speculating for the futures prices of cryptocurrencies or hedger against unexpected price movements.

BaseFEX offers cryptocurrency futures in the forms of perpetual contracts. A perpetual contract compared to the ordinary futures does not have a fixed expiry date, but they can be bought and sold indefinitely, there is no settlement at the end of the contract. The benefits of perpetuals are that usually, traders want to maintain their positions not closing them at settlement and then opening new positions, so with perpetuals is it easy and convenient to trade continually on crypto futures without worrying about the administration of settlement.

Bitcoin perpetuals are based on USD, Ethereum, Ripple, Bitcoin Cash, Litecoin and BnB contracts are based on Bitcoin. In addition to these, you can also enter into Bitcoin and Ethereum perpetuals based on USDT Tether. The base of the perpetual contract is priced on an index (USD, BTC or USDT). Each contract worth 1 USD of Bitcoin. In a BTCUSD perpetual contract, for example, the base currency is BTC and the quite currency is USD.

For each contract that has been outstanding at the cutoff times, a funding rate must be paid. The Funding is paid in every 8 hours and calculated based on a premium to an index rate provided by BaseFEX. The underlying index is a time weighted average price of the Bitcoin lending rate, that is quoted regularly by BaseFEX. Funding rate is always exchanged between users and not paid directly to the exchange but paid between the long and short position holders.

The financing rate is the underlying mechanism that set the price of the perpetuals. This rate keeps the open-ended contracts close to the cash price. If the perpetual contract prices is above the spot price, so traded at a premium the funding is a positive number, so long position holders must pay the funding rate. This discourages long positions and incentivizes short positions. In contrast when the perpetuals are traded at a discount, lower compared to spot prices, then the long positions are encouraging and the short position holder are discouraged to enter into a contract by paying the funding fee. This dynamic price corrections makes sure the current prices are always traded towards the cash price.

Margin Trading

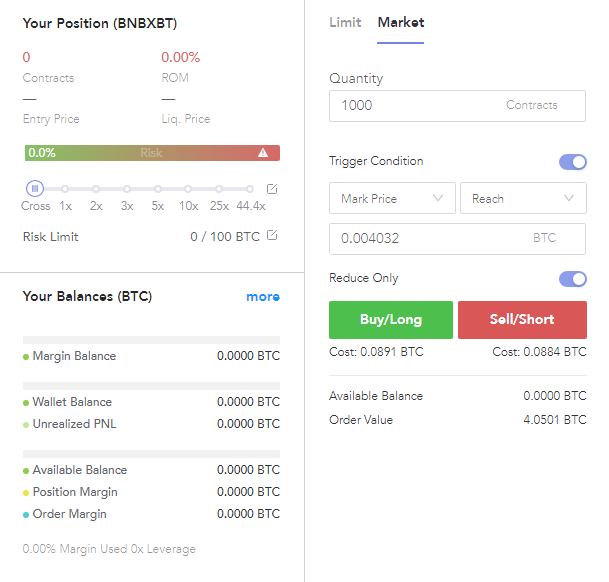

The maximum allowed leverage at BaseFEX is 100x for the BTC and 20x for the rest of the altcoins. Margin trading means by which traders use funds provided by a third party to increase their potential profits. Compared to ordinary trading accounts, margin accounts give traders access to additional amounts of capital which enables them to take advantage of their positions on a bigger scale. Essentially, margin trading boosts trading results so traders can make greater profits on successful deals. Be careful however, only use margin trading at your own risk as with greater profit potential a greater loss option comes with.

BaseFEX also offers margin funding for investors who are not risk-averse that allows them to trade on the margins themselves. During margin funding, users can commit their money to fund transactions of other users’ margin.

Full contract details are available on the specific perpetual contract pages including margin requirements, contract sizes and funding details.

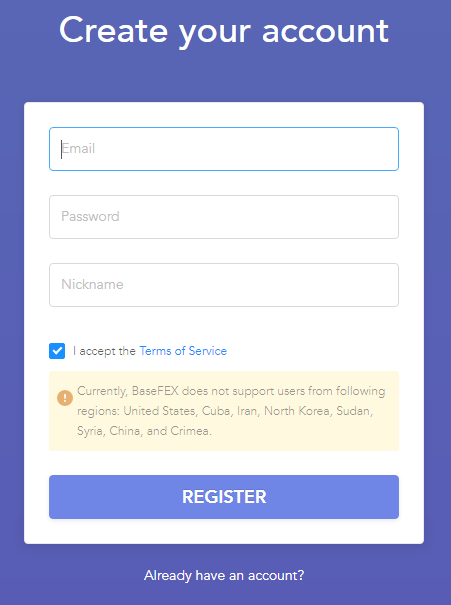

Take note, if you are a resident in one of the following countries you are prohibited from using BaseFEX’s services:

United States, Cuba, Iran, North Korea, Sudan, Syria, China, and Crimea.

Order Types on BaseFEX

Market, limit and stop orders are available on BaseFEX.

Market orders are executed right away when entered into the order book at the best possible price available on the market at the moment the order is placed.

Limit order is an order to buy or sell at a previously specified price. Limit orders are visible to the market.

Stop orders, on the contrary, are not visible by the market and once the trigger price is reached a limit or an ordinary market order is entered into the order book.

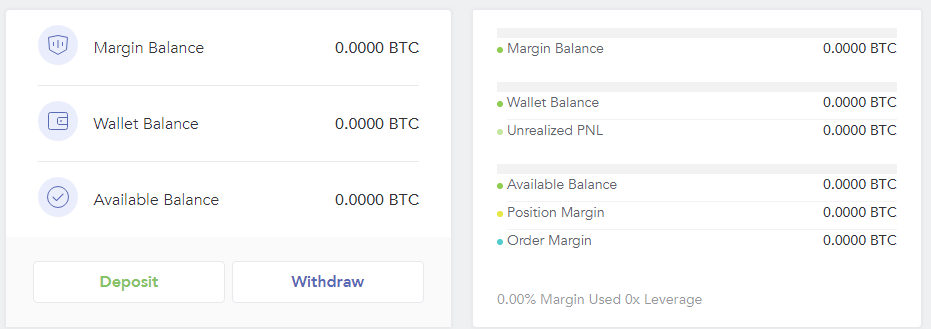

Withdrawals and Deposits on BaseFEX

BaseFEX is a crypto-only exchange so no need to go through a lengthy KYC and AML process to verify your account. Up on registration you only have to confirm your email address you have provided.

The minimum deposit amount is 0.0001 BTC on BaseFEX and deposits are credited to your account after the first confirmation. There is no deposit fee on BaseFEX. Each time a new unique deposit address is created to ensure security of the platform.

Although you can trade with 10 different altcoins on BaseFEX only Bitcoin deposits and withdrawals are available on the platform.

The minimum withdrawal is also 0.0001 BTC and the only fee applicable is the miner fee you need to pay to the network to process your transaction. Withdrawals are fully automatized, make sure you check the withdrawal address as there is no option to reverse a withdrawal sent after submission.

Fees on BaseFEX

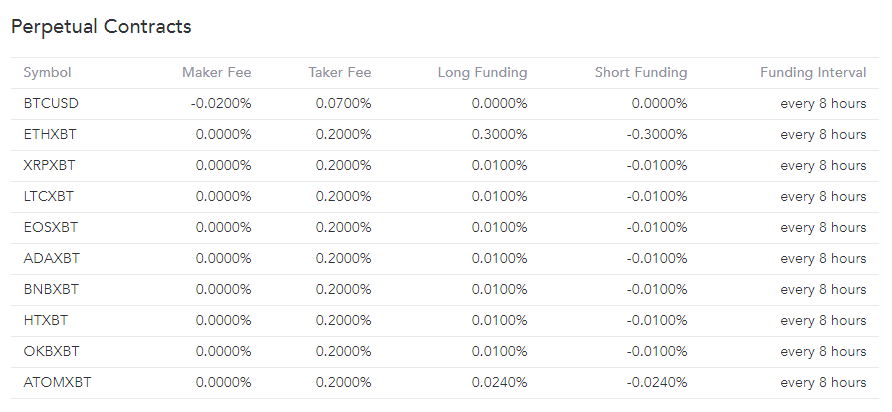

BaseFEX uses a maker-taker fee model. Maker fees are paid when you add liquidity to the order book by placing a limit order below the price for buy or above the price for sell. Taker fees are paid by those traders who remove liquidity from the order book by placing an order that is executed against an order already existing in the order book.

The maker fee on BaseFEX is 0 for most altcoin contracts and -0.02% for the BTCUSD trading pair. This means if a trader is adding liquidity to the Bitcoin market they are paid for placing such order in the order book.

On the other hand, the taker fee on BaseFEX is 0.2% for altcoins and 0.07% for BTCUSD trading pair.

These prices are considered relatively low compared to other market participants especially the negative maker fee.

In addition to trading fees you also need to calculate with paying or receiving funding fees. The funding rates are calculated in every 8 hours based on the lending index of each coin and it is usually between 0.01%-0.3%. The funding rates are paid between long and short position holders.

For large scale traders, BaseFEX offers special discounts. If your total order value exceeds 35M dollars in 7 consecutive days the commission fees are reduced by 50%.

User Experience on BaseFEX

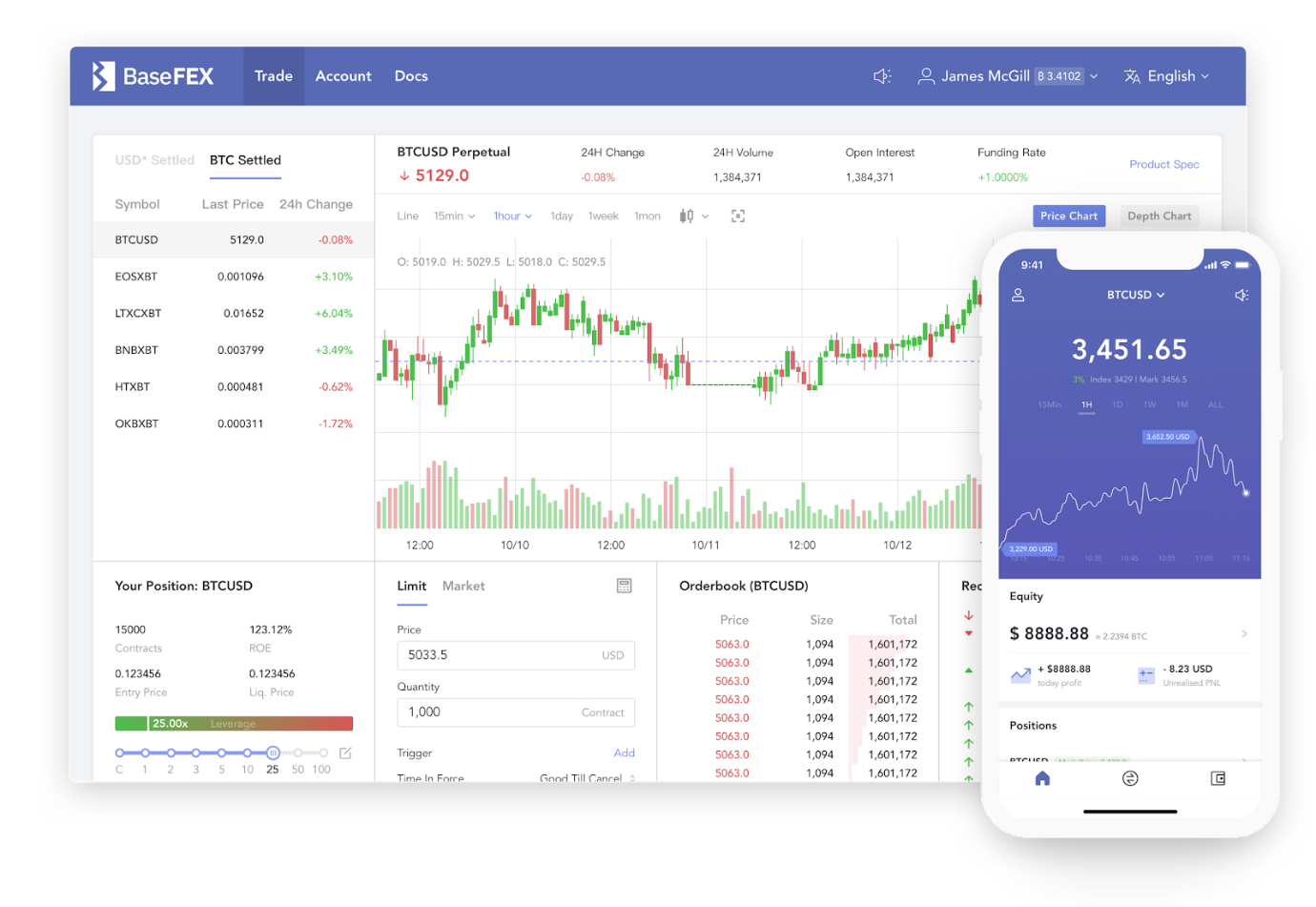

BaseFEX’s website is designed in a neat, responsive design so you can read the content and use the exchange from any device including your laptop, mobile or tablets.

The site has been translated into 5 different languages, you can choose from English, Japanese, Korean, Chinese and Russian.

There is a lot of content available on the site about how to use perpetuals and how margin and spot trading works on the platform. There was a criticism by some users on BitcoinTalk that the content has been lifted, however, BaseFEX responded to all queries in the topic.

Their customer service is working 24/7, you can reach BaseFEX on email, Telegram or on Twitter. They also regularly post on BitcoinTalk forum if a question or concern arises about the platform.

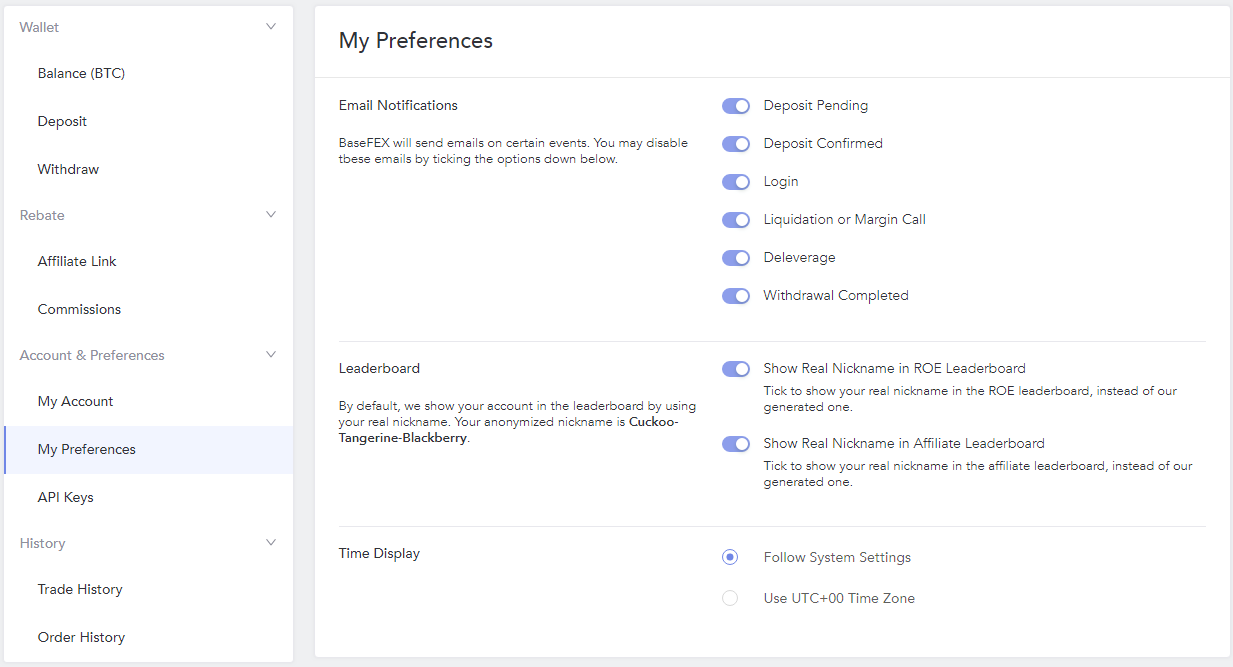

All of the assets of the crypto exchange are stored in secure cold wallets offline from the platform using multisignature security. It is also highly encouraged to use two-factor authentication when setting up an account at BaseFEX to avoid unauthorized access to your account. In the preferences, you can set if you would like to receive notifications about your account activity to make sure you are always on top of your finances.

The BaseFEX API key can be found on GitHub you can plug the trading platform directly to your trading bot if you would like to automate trading.

Conclusion

BaseFEX is a recently launched crypto exchange offering cash settled Bitcoin and altcoin futures in the forms of perpetuals. The fees are low compared to other exchanges especially considering the rebate on maker trades. The trading interface is well designed and the trading engine can handle many transactions in the fraction of seconds. BaseFEX can be a good choice for those who are interested in derivative crypto trading the only concern about the exchange that is a relatively new platform so it needs some time until it gets track record and can prove it is an honest business.

Pros

- Low fees, maker rebates

- Cash settled altcoin perpetuals

- Margin trading up to 100x

Cons

- New exchange with no real user track record

- No real social media activity

- US users are excluded from the service