Trading Precious Metals with Bitcoin

Precious metals are referred to as the commodity subclass which has a high value because of limited supply. The demand for these products can come from both industrial usages but could also come from the perception that their store of value is better compared to other asset classes. Arguments that fit bitcoin, the most popular cryptocurrency as well bringing bitcoin closer and closer what digital gold can offer.

The good news is that there are many trading platforms already on the market which offer an easy, low-cost, and quick way to exchange and precious metals and bitcoin. Let’s see how these work and which is the best trading platform for precious metals with bitcoin.

There are a couple of ways you can start trading with precious metals using bitcoin. If you choose a platform that directly accepts bitcoin deposits and offers precious metals product for trading is clearly the easiest way. But you can also choose a platform with fiat money deposit which offers trading both precious metals and bitcoin then you will have the option to quick and cost-efficiently diversify your portfolio within these two assets classes without leaving the trading environment. Finally, the last emerging trend is gold back stablecoins which are growing popularity in recent months. We will get to this part as well later on.

Review Contents

- Precious Metal Markets

- Digital metals

- Similarities of Gold and Bitcoin

- Conclusion

- Best Brokers to Trade Precious Metals with Bitcoin

- FTX (Pax Gold and Tether Gold trading options)

- PrimeXBT (silver and gold trading with bitcoin)

- Overbit (silver and gold trading up to 500x leverage)

- Evolve Markets (trade with palladium and platinum using bitcoin)

- SimpleFX (no KYC gold CFD trading with crypto deposits)

Precious Metal Markets

Precious metals by definition is a chemical element naturally occurring which has high economic value. They are usually less reactive to most elements offering versatile use cases in the industrial manufacturing processes. These metals have also been used frequently as money over history as they tend to preserve value pretty well. As a complete asset class, precious metals are referred to as bullion on the commodities market and valued by the mass and purity of the metal.

Gold is probably the most popular precious metal from the investor’s perspective as beyond its industrial demand gold is often used as a hedge against systemic financial instability, inflation concerns and geopolitical risk as gold has a low correlation with traditional asset classes.

Silver has been gaining more and more popularity in terms of value storing capability in the recent economic turmoil environment, but it has been used widely in the industrial manufacturing processes creating an evergreen demand for this precious metal. Photography, electrical appliances, batteries, circuits, and conductors all use silver as an input in the manufacturing.

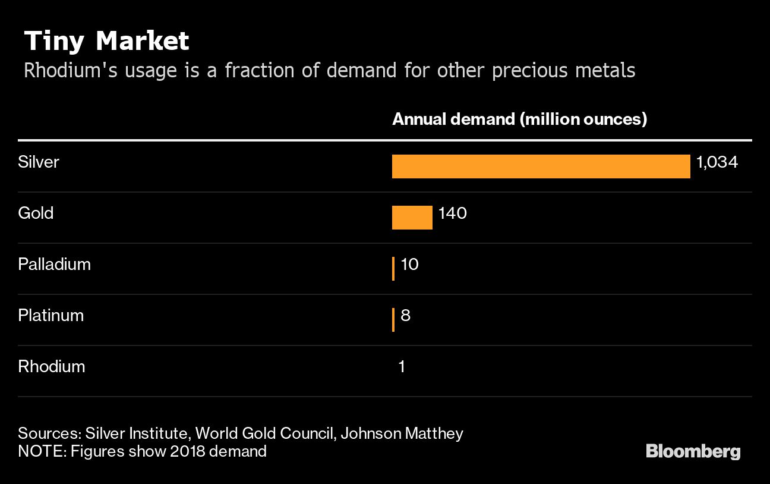

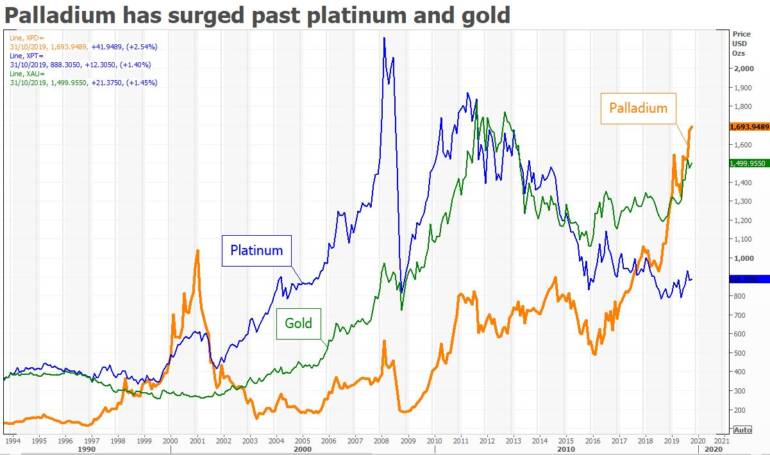

Other expensive metals include rhodium, platinum, and palladium all used in various industry sectors but less considered as a store of value from the investor’s side. Although their trading volume is smaller than in the case of gold and silver they are still providing significant earnings potential on the precious metals market.

Digital metals

Last but not least it worth mentioning the increasing occurrence of digital products backed by gold and precious metals. On the traditional markets, you can trade commodities using ETFs, funds, futures, options, and certificates. While all of these options have their pros and cons it is very common, that the required investments are pretty high otherwise your transaction costs (fees, commissions, taxes, and transportation costs) will be too high. Digital metals offer a convenient way to invest in precious metals even for a fraction of a gold bar and you can also transfer these assets between individuals or between countries making it a truly digital investment solution.

The gold-backed stablecoins are cryptocurrencies where the price of the coin is backed by gold. There is a reserve place in custody to provide collateral for the issued coins. The coins can be bought, traded, or redeemed for gold bars and integrates smoothly into the cryptocurrency ecosystem. The most popular gold back stablecoins, Pax Gold and Tether Gold, the first can also earn you money while holding it through staking.

Similarities of Gold and Bitcoin

There are quite of few similarities between gold and bitcoin as an assets class.

Both gold and bitcoin are traded 24/7 on the markets with no closing and opening period making a more frictionless market compared to traditional stocks. Since they do not correlate with the stock and bond market, gold and bitcoin are often used as a hedge to diversify a portfolio against financial instability.

As a scarce natural resource, the amount of gold available in the mines are limited. Although depending on the demand and price of gold, further mining facilities can be opened which have a higher production rate but ultimately the amount of gold ore available is limited. In the case of bitcoin, there are only 21 million bitcoins that will be mined over the next couple of decades with a decreasing production rate due to the halving events. Scarcity feature in case of gold and bitcoin ensures an increasing price curve over time as if the demand for gold or bitcoin increases but the supply is constant it will elevate the equilibrium price.

The stock-flow model in the case of bitcoin is especially concentrating on the scarcity feature of bitcoin. Stock flow is the measure of the available stock of an asset compared to the annual production. The model compared the stock-flow ratio for gold, silver, and bitcoin and drew a conclusion for it’s expected price of bitcoin for the coming years. While past price behavior is never a guarantee for future performance is worth noting that during the prior years the stock-flow ratios followed the model predicted curve.

Conclusion

Precious metals, specifically gold has been treated as a financial safe haven for centuries providing value preserving ability even when the traditional markets were under fire. Since bitcoin emerged 10 years ago, it is growing year by year into a similar product that is providing diversification benefit over geopolitical risk exposure. The good news is that you do not necessarily need to choose between gold and bitcoin now. Many brokers provide solution to trade precious metals with bitcoin or keep the trading portfolio on the same platform. Beyond gold and silver, some less liquid and more profit potential metals, like palladium is available for trading with bitcoin by now, so you will surely find your desired product in the offerings of these brokers.

Best Brokers to Trade Precious Metals with Bitcoin

FTX (Pax Gold and Tether Gold trading options)

FTX is a derivative trading platform specialized in leveraged cryptocurrency trading. You can gain access to the gold market without CFDs, investing, and trading directly with cryptocurrencies, such as Pax Gold and Tether Gold. The price of both stablecoins are linked to the price of gold and offers an easy international trading option for gold bars. Beyond trading on the spot market, you can also trade with FTX’s own leveraged tokens, which allows you to benefit from market volatility without taking any side of the market. Pax Gold futures and perpetual contracts lets you gain exposure and bid on future market prices.

FTX has been founded by an ex-Google engineer and a former hedge fund trader with having in mind what crypto trader needs: fast and reliable service, a vast variety of altcoin selection, and low trading fees. This is why FTX.com was launched, to fulfill these wishes.

You can deposit both cryptocurrencies and fiat currencies on FTX, in terms of fiat currencies however you need to pass basic KYC verification first. Deposits are free of charge, but fiat withdrawals below $10k are charged at a flat rate of $75. FTX charges a volume-based maker-taker fee model, from 0.01% to 0.07%. You can get discounts on trading fees if you are holding the platform’s own native token, FTT. Leveraged trades are charged at 0.10% for opening and closing the positions and an additional 0.03% for daily management fees that are calculated continuously. Beyond the basic order types, you can also open stop-loss limit/market, trailing stop, and take profit limit/market orders at FTX.com

PrimeXBT (silver and gold trading with bitcoin)

PrimeXBT offers gold and silver CFD with bitcoin deposits at low trading fees. Being on the market since 2018 with registered headquarters in Seychelles, and St. Vincent and the Grenadines, PrimeXBT serves now almost all countries worldwide with the exception of the United States due to local regulations.

Commodities CFDs can be traded against fiat currencies, XAG (silver) against AUD and USD, while XAU (gold) against AUD, EUR, and USD up to 100x leverage. You can execute all of the basic order types with market and limit order to manage risk and protect your profit. One Cancels the Other advanced orders also lets you enter into parallel orders at the same time to make sure you benefit from any type of market movement.

Even though both gold and silver are traded against fiat currencies, PrimeXBT is a crypto-only broker, you can only deposit bitcoin on the platform. Since no fiat payment is available on PrimeXBT, you can start trading right away without the need to go through a long KYC process. The trading fees are fairly good, with a flat 0.05% trading fee, the daily financing fees are depending on the underlying products, costs usually between 0.04%-0.075%.

Overbit (silver and gold trading up to 500x leverage)

Overbit is a cryptocurrency trading platform specialized in extra high leverage with bitcoin deposits. You can trade both gold (XAU) and silver (XAG) against the USD on Overbit with up to 500x margin which is extraordinarily high compared to other providers on the market. With an isolated margin account, you can make sure that any potential loss will not go higher than your isolated, dedicated margin account, so high leverage will not affect your overall account in case of in favorable market conditions.

Founded in 2019 Overbit supports many countries worldwide, but not the United States or Quebec in Canada. The company is registered in Seychelles, founded by a former computer engineer. Beyond bitcoin, you can also deposit USDT Tether stablecoin on Overbit to fund your account.

At Overbit you can decide yourself if you want to pay a fixed trading fee or you prefer to pay the commissions based on the bid-ask spreads. If you choose spreads, the buy and sell prices for metals will be higher and lower, in the fee mode, the trading fees is 0.1%. In the case of open leveraged positions, you also need to pay funding fees three times a day every 8 hours that is varying according to market conditions. You can open both market and limit orders at Overbit, so you can use take profit or stop losses for risk management.

Evolve Markets (trade with palladium and platinum using bitcoin)

Evolve Markets is offering uniquely palladium and platinum trading beyond the usual gold and silver trading using bitcoin deposits up to 500x leverage. This is a very unique combination on the market, you will not find another broker offering both bitcoin deposit, high leveraged, and these trading instruments of these metals. Gold and silver are both traded against USD and EUR, while platinum and palladium trading pairs are available against the USD.

Evolve Markets has been around for quite some time now, as it has been founded in 2016. The company is registered on St. Vincent and Grenadine and offering bitcoin-only deposits for residents of 150+ countries worldwide. The only restricted country on Evolve Markets is the United States, but they reserve the right to reject any account applications from jurisdictions where CFD trading with bitcoin is not allowed. The good news is that there is no KYC on the trading platform so you can deposit cryptocurrency (bitcoin and litecoin) to your account and trade on their proprietary trading platform or directly on MetaTrader 5 right away after funding your account.

There are no deposit or withdrawal fees on Evolve Markets, and the trading fees are as low as 0.0035% for commodities transactions. Just bear in mind the minimum withdrawal is 0.005 BTC or 0.005 LTC from the platform.

SimpleFX (no KYC gold CFD trading with crypto deposits)

SimpleFX offers gold and silver trading up to 50x leverage. Fund your account with one of the 10 altcoin payment methods, including bitcoin, litecoin, bitcoin cash, dash, monero, ethereum, ethereum classic and start trading right away without any worry on KYC verification process.

SimpleFX has been founded in 2014 in the United Kingdom, and the company provides services worldwide using MetaTrader servers with low latency and minimum slippage. Within the commodities asset class, you can trade gold (XAU) against AUD, EUR, and USD, while silver (XAG) against AUD and USD. Both metals can be traded from a 2% margin that is resulting in 50x leverage. The OTC markets are open 24/7 for metal trading.

There are no deposit or withdrawal fees on SimpleFX, but bear in mind the only allow withdrawals in the same currency and payment method which was used for depositing on the platform. SimpleFX has no trading fees either, their commission is coming from the bid-offer spreads. If you do not use your account for a certain period of time, SimpleFX will charge a 3% inactivity fee (min $25) on your balance to incentivize you to use your funds.