Trading Crude Oil with Bitcoin

Due to its unique geopolitical risk correlation, oil offers great opportunities to exploit market conditions and increase your overall portfolio returns through diversification and hedge. A very similar narrative evolved around bitcoin which resulting in a profitable combination if you trade oil with bitcoin.

The energy sector is growing year by year which also increased the volatility in the prices sharply during the past couple of years. Higher volatility provides good exposure for oil traders for both on the short term and long term markets.

Trading oil with bitcoin by now is possible on several cryptocurrency trading platforms. Here are the steps you need to go through to trade oil with bitcoin

- Get some bitcoin

- Deposit your bitcoins on trading exchanges

- Wait for the coins to be credited to your account

- Start trading with oil using your bitcoins

Review Contents

- How does Crude Oil Trading Work?

- Different type of oil products

- Different types of contracts

- Conclusion

- Best Brokers to Trade Indices with Bitcoin

- FTX (oil futures)

- PrimeXBT (low fees)

- SimpleFX (bitcoin deposits)

- Avatrade (many different types of oil contracts)

Using bitcoins as a deposit for oil trading lets you keep your finances, including profits and losses private and hidden from the scrutiny of others.

Although you can trade oil directly with bitcoin you also have some other options to benefit from using bitcoin. If you do not want to use bitcoin directly but want to have exposure to both bitcoin and oil on the same trading platform that is also possible at several brokers who are offering fiat payment options as a deposit.

How does Crude Oil Trading Work?

There are many opportunities in crude oil trading since there are different oil products and contracts, so there are a lot of different combinations you can come up with for a profitable strategy.

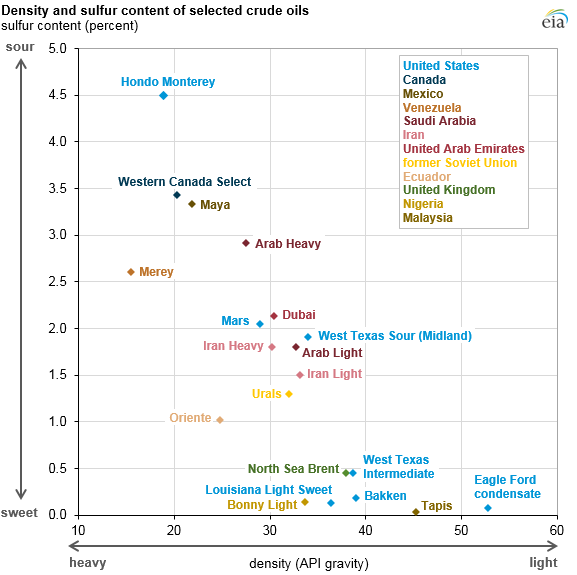

Different type of oil products

The crude oil is classified based on the geographic location where the product is extracted. The regional differences of the oil shells also result in different quality of oil that is measured through the gravity or density and the sulfur content of the liquid. Crude oil is light if the density is low and in contrast, crude oil is heavy if the density is high. Sweet and sour crude oil is referring to the sulfur content of the liquid.

The following aspects impact the final price of crude oil:

- location of the oil field impacts transportation costs

- light oil results in a higher yield of gasoline

- sweet oil has less environmental issues when refined

Based on the geographic locations crude oil is classified into the following classes. WTI is the short form of West Texas Intermediate, a high quality, light sweet oil in Oklahoma, US. Brent is located in Northern Europe and consist of 15 oil field in Shetland. Dubai-Oman oil is used as a benchmark for the Middle East.

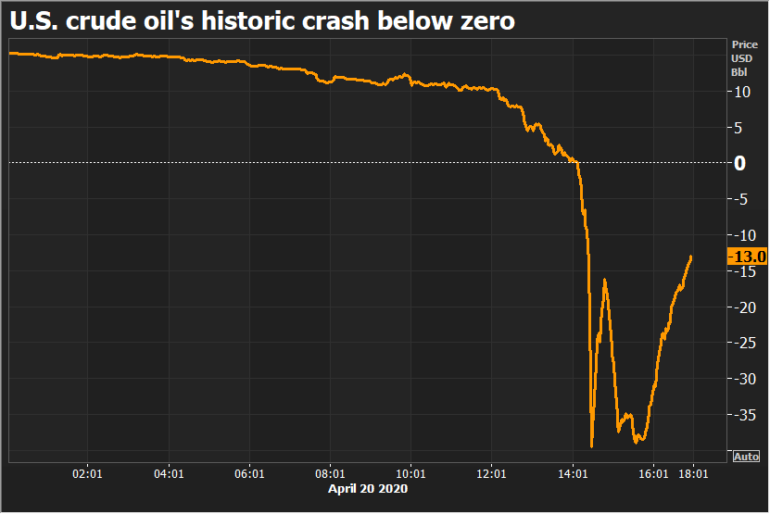

The physical location of the oil field plays a very important role in the pricing of the contracts. In April 2020 the WTI May futures prices sank to the negative territory because of a serious supply and demand-side shock. As a result of low demand from aircraft due to COVID pandemic, but large supply provided by the OPEC’s dumping, the oil reservoirs were loaded fully at Cushing. When the physically settled May oil contracts were about to reach settlement there was literally no one who was willing to take over the oil so the holders of the contracts were even offering money to take oil from them causing a never seen before negative price.

Different types of contracts

You can trade on the spot and futures oil market. While the spot market represents the current market, the futures contract lets you speculate or hedge on the future price of oil. Even using bitcoin you can still bet on the future price of oil at given expiration date.

As we have seen above, beyond the location of the oil field the type of contract you trade oil with is an important aspect. For physically delivered oil contracts the underlying commodities, in this case, oil barrels are delivered in person to the holder of the contract at execution. On the other side in case of cash-settled contracts are only payable in cash the difference of the contract price and the market price at the settlement date.

If you finance your account with bitcoin, in most of the cases you can speculate on the future price of oil but the execution will happen in cash as there is no physical delivery. You will not need to worry about taking over hundreds of barrels of oil delivered to your front door.

Conclusion

Oil trading has gone through some serious ups and downs in recent times offering high volatility and trading gains. Traditionally oil prices tend to appreciate over time, providing diversification benefits to a portfolio of traditional assets. Bitcoin can help you to achieve privacy over your own finances, combining oil trading with bitcoin thus enables you to profit from fluctuating oil prices while still keep your personal information off the internet. Having both bitcoin and oil in your trading portfolio can ensure a well-diversified basket and having both assets on the same trading platform can help you to exchange bitcoin to oil in a cheap and quick way.

Best Brokers to Trade Crude Oil with Bitcoin

FTX (oil futures)

FTX is a cryptocurrency derivatives exchange offering low fees and high leverage with various asset classes. With their leveraged tokens and stablecoin collateral wallets, you can trade on margin in a convenient and effective way.

FTX was founded in 2019 by Sam Bankman-Fried, a prior hedge fund trader and Gary Wang, az ex-Google engineer in Hong Kong and their leveraged trading solution quickly became popular worldwide. Since FTX is a not just crypto-only trading platform you can deposit digital coins, using BTC, LTC, BCH, ETH, XRP, EOS, or BNB but also using 10+ different fiat currencies, including USD, EUR, and BRL interbank transfers and credit cards.

Note however if you are using fiat currencies, you need to pass KYC verification to be able to deposit using these funds. FTX services available worldwide except for a handful of countries, at the moment they are not accepting user registrations from United States residents and oil trading specifically is not permitted to UK, Singapore, and Canada residents either, although users from these countries can still register and use parts of the platform’s services.

FTX recently introduced oil futures on the trading platform which lets you to bet on the future price of oil contracts. The price of the FTX oil futures follows the WTI oil price as an underlying asset and on expiration, the price equals the WTI Spot Price + $100. You can trade up to 100x leverage on oil contracts. FTX follows a tier-based maker-taker fee model, where you can trade for 0.02%-0.07% trading fees. Leveraged trading has a 0.1% initiation and closing fee with 0.03% daily management. There are no deposit or withdrawal fees charged on FTX.com.

PrimeXBT (low fees)

PrimeXBT is a bitcoin trading platform which lets you gain exposure to various trading markets using bitcoin deposits. You can trade 30+ different assets on PrimeXBT, including WTI and Brent oil contracts and Natural Gas trading. After registration and deposits, you can start trading right away as there is no KYC verification process needs to be done.

You can trade up 100x leveraged on oil products using direct bitcoin deposits. If you do not have bitcoin on hand, in partnership with Cex.io you can purchase bitcoins directly with credit cards. Withdrawals are also available in bitcoin only and there are no fees charged for it.

PrimeXBT is registered on Seychelles in 2018 and providing services globally to 170 countries. You can use various advanced charting tools offered by TradingView on PrimeXBT and execute orders up to 100x margin. WTI and Brent oil contracts are available in the forms of CFDs on PrimeXBT, so you can both short sell positions and no need to worry about physical delivery.

Beyond the basic order types of market and limit orders, you can also build more complex trading strategies using One-Cancels-The-Other conditional advanced orders.

In terms of fees, PrimeXBT charges 0.01% trading fees with 0.020%-0.023% financing rate on open positions on WTI (CRUDE) and Brent contracts which are open after midnight. Compared to cryptocurrency markets which are open 24/7, oil markets are only trading between 0:00 – 21:00 UTC time Monday to Friday, consider this when building up your trading strategy.

SimpleFX (bitcoin deposits)

SimpleFX is a leading worldwide broker offering cryptocurrency deposits and trading options in oil CFD contracts. Founded in 2014 SimpleFX offers a broad range of assets with up to 500x leverage even on oil contracts. Supporting 160 countries worldwide from its headquarter in St. Vincent and the Grenadines, SimpleFX is offering CFD contracts to be able to benefit from both uptrend and down trending markets.

Using CFD contracts you can easily short sell positions without the need to purchase them upfront so you can follow and trade along with different market conditions easily. Using MetaTrader 4 or their proprietary trading platform you can excess to a lot of different trading and charting tools, including API access and mobile trading options.

You can deposit 8 different cryptocurrencies on SimpleFX with the additional option of ordinary credit cards deposit using USD and IDR in partnership with Fasapay. Take note that SimpleFX allows you to withdraw from the platform in the form you have deposited your initial funds, if you used several payment method, you can withdraw only using the payment method you used for your largest deposit.

Within the energy sector, both US Oil (linked to the WTI price) and UK Oil (linked to the Brent oil prices) are available on SimpleFX besides natural gas trading. All prices are quoted against the USD, but you can deposit cryptocurrencies on the platform. If you use bitcoin, ethereum, litecoin, or other crypto deposits, you do not need to go through a KYC verification process, so you can start trading immediately after funding your account.

Trade with market or limit orders on SimpleFX to manage the risk of your portfolio. Take profit and stop-loss orders can help you to execute your trading strategy accordingly. There are no hidden transaction fees on SimpleFX, all of the trading commission is built into the bid-ask spreads which are fairly competitive, starting from 0.1 pips. Note however if you have an open position after midnight you will be charged overnight rollover and swap fees. In addition, SimpleFX also charges an inactivity fee of 3% (minimum $25) on your prior deposits.

Avatrade (many different types of oil contracts)

Avatrade is a leading regulated trading platform offering services worldwide since 2006. The broker provides professional trading experience for both cryptocurrencies and oil trading within the same framework, so you can easily build a portfolio combining these two assets. Beyond the online trading platform, you can also trade on Metatrader 4 and 5 with also options for mobile devices.

Avatrade offers CFD trading in a relatively large variety. Beyond just crude oil, you can also trade with heating oil, gasoline, and also natural gas in the energy sector CFDs. In terms of crude oil, you can choose between Brent and WTI to trade against USD. You can also trade on leverage with oil instruments, up to 10x margin is available for oil CFD positions and these are not actual contracts of the underlying assets, but CFDs – papers that follow the price movements of the underlying assets, you can also short sell oil using these products at Avatrade.

Currently, only fiat deposits are available at Avatrade, using VISA cards, wire transfers, Skrill or Neteller. No cryptocurrency deposits or withdrawal are listed as an option, however, once you have funded your account you can convert your balances into several different altcoins and bitcoin to get a really well-diversified portfolio.

There are no trading fees on Avatrade, all of the commission is built into the bid-offer spreads of the contracts. For oil contracts, Avatrade uses a spread of $0.03. Note however if you have an open position beyond midnight you will need to pay an overnight premium charge. Also, if you open an Avatrade account, make sure you use it, after 3 months of inactivity they will charge $50 for not using your funds for trading. Be it a market order, a limit order, or any type of risk managing order type, make sure you open a position in every 3 months, otherwise, your account will be charged.