Trading Commodities with Bitcoin

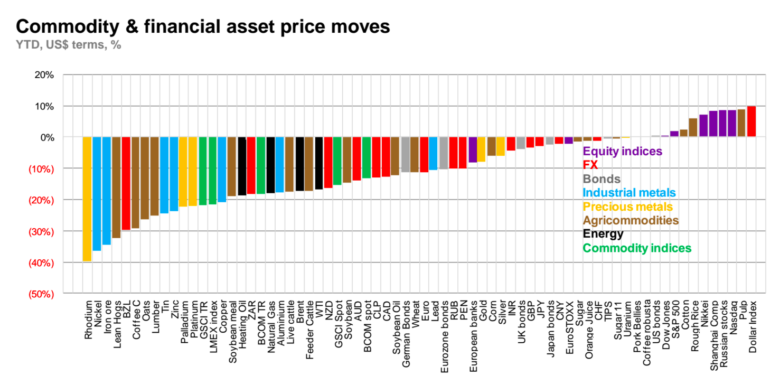

Although by volume commodities seems to be the smallest asset class compared to stocks, bonds, and the forex market, the diversity of the products within the industries are so versatile that this line item is not something you could miss from a well-diversified portfolio.

Diversification helps you to protect your portfolio return from business cycles. When the stock market is going down, the commodities market usually stays on top of the decline and providing an adequate return to keep your portfolio positive.

But did you know you can also trade commodities with Bitcoin? Yes, it is possible! Bitcoin, the cryptocurrency launched in 2009 quickly become a standalone asset class on the financial market, and by now many trading platforms offer the option to trade Bitcoin against metals, oil, or other commodities products. Bitcoins provide anonymity over the transaction history which makes often appealing to keep finances private.

To trade commodities with Bitcoin, you have two options. You either need to have Bitcoin before registering to a trading platform or you need to choose a platform that lists Bitcoin as a tradable asset so you can diversify your portfolio accordingly within the same platform, helping you allocate your portfolio weight in a cost-efficient way.

Trading commodities with Bitcoin includes the following step:

- Buy Bitcoin at a Bitcoin broker

- Deposit Bitcoin to a trading platform where you can trade commodities against BTC

- Wait for your deposit to be confirmed over the blockchain

- Start trading commodities with Bitcoin

Review Contents

- Specialties of Commodities Trading and Bitcoin

- Top trading commodity goods

- Conclusion

- Best Brokers to Trade Commodities with Bitcoin

- FTX (oil futures, PAXOS Gold)

- PrimeXBT (NatGas, Oil, Gold, Silver)

- Overbit (gold and silver)

- Evolve Markets (natgas, gold, oil, silver)

Specialties of Commodities Trading and Bitcoin

Commodities market refers to the primary economic sector that produces the raw materials needed for manufacturing processes.

Maybe one of the most important aspects of commodities as an asset class that’s prices usually go against the traditional assets, providing hedge opportunities for market turmoil. However itself commodities can be a more risky asset class compared to stocks and bonds as the supply and demand for basic goods are more exposed to uncertainty, like weather or disasters.

There are many different sub-classes within Commodities. Before we briefly touch these items, it worth noting, that Bitcoin itself is considered sometimes a commodity. The reason behind that is that there is only a limited number of Bitcoins will be mined over the years, making is a scarce product just like in the case of natural resources.

Although commodities can be used as a means of exchange or in barter transactions, their fluctuating prices make is an inconvenience to use is a money replacement. Bitcoin has been going through some massive volatility period, so behaving like a commodity. By definition, a commodity is an object which has a value, a value that is created by market supply and demand. This definition suits Bitcoin pretty well.

But this is a never-ending argument between analysts and regulators whether Bitcoin and cryptocurrency should be considered as a commodity or rather a currency. I guess only time will tell what is the truth.

Top trading commodity goods

Commodities as an asset class are divided into four main sub-classes: metals, energy products, agriculture goods, and other alternative assets. The reason for commodities trading emerged from the need of the manufacturers, as due to the volatile nature of these products, hedging is a crucial part of the manufacturing processes to lock expenses and revenues ahead of time.

Metals – There are two forms of metals traded on exchanges or in OTC markets: precious metals and industrial metals. Precious metals, such as gold and silver have a metallic element that has high economic value – namely, it is expensive. Beyond gold and silver, palladium and platinum are also considered precious metals according to the ISO 4217 standard defining these materials. Precious metals are traded in troy ounce measurement, which is a historical measurement equals to 31 grams. Gold is considered as a value preserving asset, so its value has already deviated decades ago from its intrinsic value of economic usage. The other subclass within metals is the industrial-grade metals, which are sold based on metric tons on the exchanges. Copper, aluminum, lead are all used in the manufacturing processes worldwide making the market demand and supply truly global.

Energy – The energy sector includes those commodity products that can produce energy. The biggest portion of this asset class is the various forms of oils and natural gas, but some forms of acids are also considered and traded as a commodity product. The oil industry is divided up based on the regional oil field, the most generally known oil types are WTI in the US Coastline, Brent in the Northern part of Europe, and Gulf Coast Crude Oil in the Middle East. Each of these oil fields has its own unique features and mechanism, so these minimarkets usually result in different price actions. Unlike oil, natural gas is not located in only distinct regional locations but spread out more globally.

Agriculture – Agriculture products include food items in various forms such as grains, corn, soybean, and even livestock and meat. The definition of this asset class, that is derived from living organisms like plants or animals. By now the most tradable agricultural products are soybean and wheat.

Other important commodities markets beyond the above list include diamonds, rubber, and palm oil.

Conclusion

Commodities offers diversification benefits over traditional financial markets price volatility. Bitcoin has very similar functions so combining it with commodities trading you can certainly widen your risk management tool, while profiting from market fluctuations. Trading commodities, like metal, oil or even natural gas are getting more and more popular with several platforms arising with this service. You can keep your bitcoin and commodities trading portfolio on the same platform and switch between the asset classes any time you want – in a quick and cost efficient way, while still making sure your personal financial information is not disclosed.

Best Brokers to Trade Commodities with Bitcoin

FTX (oil futures, PAXOS Gold)

FTX.com is a cryptocurrency derivative exchange offering low fees, tight spreads, and deep order book. With their leveraged tokens, you can profit from market movements without deciding on the expected directional market moves. You can participate in competitions to win cash prizes on your successful trades on a weekly and monthly basis. Founded in 2019 in Hong Kong, the derivative exchange quickly became popular worldwide. Apart from the United States FTX supports almost all countries worldwide.

FTX offers commodities trading with bitcoin deposits on the following instruments: oil and gold on the futures markets. Oil futures are traded $100 above the spot price. You can get exposure to the gold market using PAXOS Gold stablecoin or directly through XAUT-PREP perpetual futures contract. You can place market orders but there are a couple of advanced order types are available too beyond limit orders, like take profit, stops, trailing orders and reduce-only, POST or IOC to make sure you can execute your trading strategy just like you have planned.

There are no deposit or withdrawal fees on FTX. Beyond bitcoin, you can also deposit 8 other altcoins on FTX.com, including ETH, BNB, and Ripple. There is a tier-based trading fee structure based on the monthly average trading volume and n whether you take the maker or taker side of the market. Fees are gradually decreased from 0.02-0.07% down to 0.01%. You can get additional discounts on holding the platform’s native FTT token. You can trade up to 100x leverage on oil and gold futures on FTX which is charged by an additional 0.03%. There is no conversion fee charged however if you are converting assets within the platform between the wallets.

PrimeXBT (NatGas, Oil, Gold, Silver)

PrimeXBT – 1:100 The company behind PrimeXBT has been registered on Seychelles in 2018 and has an average 500M+ daily volume on various cryptocurrency, forex, commodities and stock index markets. They offer a no KYC trading solution so you do not need to verify your identity with IDs, you can start trading right away after registration and depositing bitcoin. Due to local regulations, PrimeXBT offers services up to 150 countries, but not to US or Canadian residents.

The company behind PrimeXBT has been registered on Seychelles in 2018 and has an average 500M+ daily volume on various cryptocurrency, forex, commodities and stock index markets. They offer a no KYC trading solution so you do not need to verify your identity with IDs, you can start trading right away after registration and depositing bitcoin. Due to local regulations, PrimeXBT offers services up to 150 countries, but not to US or Canadian residents.

PrimeXBT offers a wide range of commodities products that are available for trading with bitcoin. These CFD commodities trades lets you benefit from the digital markets of natural gas, crude oil in two forms: BRENT and WTI, and even precious metals such as gold and silver up to 100x margin. The customizable charting software lets you to perform the exact strategy you have planned with instant order execution. The digital markets allow you to gain exposure to commodities futures contracts without the need to worry about a physical settlement.

You can deposit and withdraw profits only in bitcoin. Even if there are multiple fiat and altcoins are listed on the platform that are available for trading there is no option however to pay with fiat currency or deposit other coins on the platform. Note however on BTC you can get extremely high leverage up to 1000x. On Commodities, you can trade up to 100x margin. The trading fees are a flat 0.01% on commodities products, with an additional variable financing rate on margin trades that are payable on a daily basis on open positions.

Order types on PrimeXBT include the most common order types such as market and limit orders that help you to create protection orders such as stop loss and take profit. They also offer OCO order type to trade with multiple order parallel on conditions.

Overbit (gold and silver)

Overbit is a fully-featured crypto trading platform offering bitcoin and altcoin trading, forex and metals with high leverage. The platform is fairly new, launched in 2019 but it quickly became popular among crypto traders because of its low fees and quick execution. The company is incorporated in Seychelles but has local offices around the globe in London, Moscow, Hong Kong, and Singapore. Overbit provides services to 100+ countries worldwide, but not to US residents.

Since Overbit is a crypto-only platform, there is no option to deposit USD or other fiat currency to your account. But beyond bitcoin, you can also deposit the USDT Tether stablecoin on the platform to fund your account. There are no deposit or withdrawal fees charged on Overbit.

At Overbit you can decide how you would like to pay trading fees. If you open your trades in spread mode they do not charge any trading fee, the commissions are coming from the difference of the bid and offer prices, called spread. In this case, the spreads will be wider compared to using trading fees mode when the fees are deducted from your cash balances. The fee is 0.075% of the notional value of the open position.

You can trade the two most popular precious metals on Overbit: gold and silver with bitcoin deposits. Overbit also offers up to 500x leverage on metal trading which is one of the higher-margin you can get on the market. Place a market order to jump ride away into the market, or use a limit order to execute your trading strategy based on different price levels. Take profit and stop-loss orders helps you to ensure your risk management is spot on.

Evolve Markets (natgas, gold, oil, silver)

Evolve Markets is a crypto-only trading platform offering exposure to various traditional markets in a truly digital way. There are nine different commodities trading pairs you can trade on Evolve Markets with a crypto deposit, including US and UK oil, Gold, Silver, and even Palladium against USD and EUR. Palladium is a unique market on Evolve Markets which is not available elsewhere with bitcoin deposits. The 500x leverage is also quite substantial compared to the average 100x margin trading options on other platforms.

Evolve Markets is a crypto-only trading platform offering exposure to various traditional markets in a truly digital way. There are nine different commodities trading pairs you can trade on Evolve Markets with a crypto deposit, including US and UK oil, Gold, Silver, and even Palladium against USD and EUR. Palladium is a unique market on Evolve Markets which is not available elsewhere with bitcoin deposits. The 500x leverage is also quite substantial compared to the average 100x margin trading options on other platforms.

Founded in 2016 on Saint Vincent and the Grenadines, Evolve Markets offers offshore broker solutions with bitcoin and litecoin deposits in over 100 different jurisdictions. The United States however is not a supported country at Evolve Markets.

There are no deposit or withdrawal fees at Evolve Markets, the commodities contracts are charged at a flat rate of 0.0035%. Beyond bitcoin, you can also deposit litecoin on Evolve Markets but there are a couple of other cryptocurrencies that are available for trading after conversion. Since Evolve Markets use straight-through processing (STP) execution model, all your orders are directly sent to the liquidity provider without touching any dealing desk. You can also use MT4 and MT5 platforms to trade on Evolve Markets with various order types, including market and limit orders, stop losses, and take profit order to manage risk accordingly anytime.