Best Bitcoin Futures Trading Broker

The hardest part when it comes to choosing the best Bitcoin Broker with Futures Trading is comparing websites that provide the service. Can you imagine how much time it would take for you to go through each and every one of them and compare their services and features! We might have a few familiar names within our listings but by the end of the day, they are just recommendations from us to you. We completely understand how hard it is to decide that’s why we have provided you guys the best 5 Bitcoin Broker websites that offer futures trading!

Before moving forward, we would just like to let you know that this is not a full review of all five websites that we will be discussing below. This is a straight comparison between these websites for their futures trading services. The comparison will include fees, features, currencies accepted, and deposit options for you to choose from. In addition, if you are now familiar with the futures contract, it is a derivative product and an agreement to buy or sell something which can be either a commodity, currency or something that has a predetermined price set in the future.

Top 5 Crypto Brokers with Futures Trading

Without further delay, let’s talk about that!

BaseFex.com Futures Trading

The name BaseFex is a new cryptocurrency derivatives and futures trading platform offering high leverage of up to 100:1. The broker is operating since end of 2018.

- Deposit and Withdrawal Methods – You can deposit or withdraw BTC or USDT (Tether) with BaseFex. They don’t charge any fees on Bitcoin transfers, the only fee that occurs at deposit or withdrawal is the usual Bitcoin network fee.

- Website Features – One of the nicest features of BaseFEX is the fact that you don’t need to proof your identity and you can start trading right away after the quick registration which only asks for email, password and a nickname. Regarding leverage it has to be said that 100:1 only applies to Bitcoin against the Dollar. For the altcoin trading pairs leverage is either 20:1 or 50:1, depending in the coin. You can check this right on their frontpage.

- Currencies being traded – The broker allows Bitcoin and altcoin futures trading for the following cryptocurrencies: Bitcoin, Ethereum, Ripple, Litecoin, EOS, Cardano, Tron, Binance Coin, Huobi Token, OKB and Atom.

Concerning trading fees, BaseFEX uses the typical maker-taker fee model. Maker fee is 0 in most cases, taker fee varies between 0.07-0.2%. Also a funding fee can occur for open positions at certain times a day.

Pros

- Quick account creation

- Also some altcoin futures

Cons

- Only accepts BTC deposits

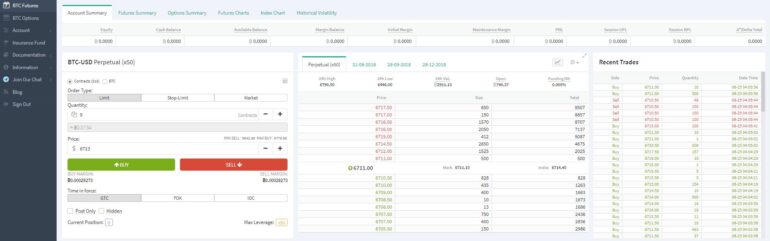

Deribit.com Futures Trading

The name Deribit comes from the words Derivatives and Bitcoin. Just like the mentioned website above, Deribit.com was also not made for new traders. An in-depth review of the website and its trading platform can be read here.

- Deposit and Withdrawal Methods – Deribit.com is one of the websites that only accept deposits in BTC. This means that their withdrawal methods are also of that of Bitcoin. There is no charge for deposits but their withdrawal fees range from 0.0002 up to 0.0015 BTC per transaction.

- Website Features – The website does not have that many features compared to other websites out there that have educational material of some sort. Deribit.com though has something that not all websites have, and that would be Insurance. They have a 25 BTC insurance system that makes sure that all trades are safe and that their website would not go bankrupt just like that. Making traders feel secure without any reasons for having second thoughts going all in.

- Currencies being traded – Deribit.com was designed to focus on one thing only, and that is BTC trading. Here they offer BTC Futures trading and BTC Options trading and nothing else. It might be an advantage to most people but seems to be a disadvantage to some that would love more than these two trading platforms.

The contract size here at Deribit.com is $10 and the maker fee is -0.02% (Rebate), the Taker Fee is 0.05%. Please be advised that contracts can be viewed as $10 each (which is equivalent to $10 BTC) or to make it easier, just select BTC for contract prices.

Pros

- Easy account creation

- Insurance

Cons

- Only accepts BTC deposits

- Not new trader friendly

SimpleFX.com Futures Trading

Creating an account with SimpleFX is purely Simple! All you need to have are minimum requirements (without ID needed) and you are also able to trade with anonymity. The website has been operating since 2014 and is located in Saint Vincent and the Grenadines. One of the things that we noticed about the website is the fact that it is designed differently from most of the trading websites today that go for a more refined professional look, with simpleFX, you get that energized feeling.

- Deposit and Withdrawal Methods – Here at SimpleFX, customers are able to choose from a lot of payment options. To name a few we’ve got BTC, DASH, ETH, LTC, Credit Cards, Skrill, Wire Transfer, and a lot more! Minimum deposits start from 0.1 USD up to 20 USD depending on the method chosen. Withdrawals, on the other hand, are a completely different story. Crypto withdrawals do not have any charge but the minimum request starts from 0.001 BTC up to 0.05 LTC. When it comes to Fiat withdrawals, the charge starts from free up to $10 per transaction.

- Website Features – People should take note that SimpleFX has a demo account for people to try out. If you are active in the BTC trade world, it is really seldom to see websites that offer test accounts.

- Currencies being traded – In SimpleFX, trades can range from Crypto/USD/JPY/Fiat pairs to Forex, Indices, Equities, and Stocks.

Maximum leverage is 1:500 and spreads start from 0.8 pips. In addition, US customers are welcome to create an account here at SimpleFX.com!

Pros

- Accepts BTC and Fiat Deposits

- Demo Account

- High Leverage

- Anonymous Trading (Optional)

Cons

- Website delay

- Some negative reviews about the website

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are highly volatile unregulated investment product. No EU investor protection.

This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

Conclusion

These are the Top 5 Websites that offer futures trading. We have provided you with all their pros and cons as well as the features they have per website. Please be advised that this list is just our recommendation and by the end of the day, it would still be your decision that matters. As always, be careful when it comes to investing money into online trading websites; always make sure that you do extra time in knowing them. For now, we would wish you guys, happy trading, and good luck!