BitMEX Review

***Update: Bitmex has massive legal problems! The CFTC Charges BitMEX Owners with Illegally Operating a Cryptocurrency Derivatives Trading Platform and Anti-Money Laundering Violations. Their former CEO is on the run. Do not trade on this platform, you don´t know if they will close the exchange and you might lose your funds. ***

Review Contents

- Creating an Account and Trading with BitMex.com

- Trading

- Leverage

- Trading Guides

- Bitmex Futures Trading

- Perpetual Contracts

- Deposits, Withdrawals and Fees

- Customer Support

- Pros, Cons and Conclusion

The trading platform is operated and owned by HDR Global Trading Ltd. and was founded way back in 2014 by very successful bankers. As you might have noticed, the front page of their website can be easily changed from English to Mandarin with just a few clicks. And yes, the company is based in Hong Kong, China. Did you know that BitMex.com is one of the largest Bitcoin trading platforms in the world today? Since they launched in 2014, they have traded $33.93 Billion worth of Bitcoin! Now that’s some serious numbers.

With this being said, are they being regulated? When it comes to trading platforms that build their businesses from Bitcoin and up, it is most likely that these w ^ebsites are unregulated by local trade laws. With that being said, if you are uncomfortable trading with unregulated websites, then it is best if you leave. You can check out reviews about Bitmex before you start as well. If you think that it is time to know this type of trading platform, and then let us proceed.

Creating an Account and Trading with BitMex.com

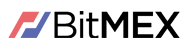

Simply head over to their website www.BitMex.com and create an account with them. It wouldn’t even take you a minute to create one. All you need to provide is a valid email address, the password for your new account, Country of Residence, and your complete name. After filling out the required information, swipe the CAPTCHA to the right and you’re good to go! After that, a confirmation email will be sent to the email address provided.

Just click on the link and you will be redirected to the website, logged into your account, and ready to trade. The problem now is do you know how to trade? We will be getting into that shortly!

Bitmex does not allow citizens from the USA to trade on their platform. Other countries like Syria, North Korea or Iran are also excluded from Bitmex. Here is an Article on using Bitmex in the USA.

Trading

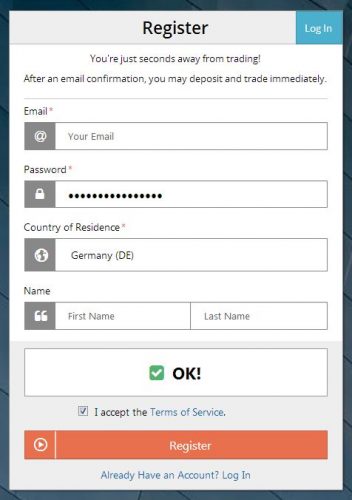

You are currently looking at the main screen of your account. On the left side of the screen, you are able to see a panel where you are able to place an order. You can also check your current positions and adjust your leverage. On the middle area of the screen, you will be shown the current data on the chosen pair. You are able to change the pair that you will be viewing through the tabs that are pre-paired above. We’ve got Bitcoin, Bitcoin/Yen, Binary, Dash, and a lot more to choose from. If you already made a trade, this will be shown on the bottom part of the screen.

How do we make a trade? Please be advised that in order to start a successful trade with a real account, you need to deposit Bitcoin into your account to finalize any trade, but that can be done later! We will just show you how to trade.

Shown on the second trade screenshot above, you can see on the left side of the screen as mentioned earlier all you need to do to create or place an order. Buy market means you are going to go long with the position and Sell Market means that you are going to short the market.

If you do not know what I meant with that, then you can read more about the difference between a long and short position in the market.

On the table, you are also able to change the leverage of your current position before finalizing any purchase. You can choose up to 1:100 leverage! After that, all you need to do is purchase the position and this will show up on the bottom part of the screen.

More on Bitmex Bitcoin Trading

Leverage

Having leverage on a trade is both risky and advantageous at the same time. Why do I say risky? If you are new to trading or in other words, a beginner, do not use Leverage. Being able to margin trade, or use leverage is strongly recommended for experienced traders due to the risk of higher losses. Here at BitMex.com, they allow their clients to have a leverage of up to 1:100. So before you use this feature, make sure that you know how to use leverage to your advantage. More on Bitmex Margin Trading.

Trading Guides and Order Types

Are there any trading guides? I do not blame you if you find it hard to understand all the clutter that is happening within their account page. If you ask me, their trading platform is definitely not for people that are new in trading. Good thing that they offer trading guides which you are able to access through this link. They have everything you need to know about contracts that they offer.

Read more about the different Bitmex Order Types.

Bitmex Futures Trading

Futures contracts have been used as a trading concept for a very long time now. Way back when the trade infrastructure of the world wasn’t as efficient as it is today, people had problems with fluctuating market prices of goods and commodities. The concept of futures contracts was made wherein the buyer/seller bought or sold an asset at a predetermined future date and price.

For example: If we were farming corn and we got a contract from a cereal company; that company will purchase our crops for a future date even if it’s still in the growing process at the current price the contract was made.

If the current price of corn was a $500 per ton and the cereal company signed the contract this means that they will be paying a fixed price of $500 per ton despite the market fluctuations that may or may not happen between the date the contract was signed and the delivery date of the corn purchased.

There’s a lot to talk about when it comes to futures contracts but today we will be focusing on what BitMEX.com offers to their traders. Without further delay, let’s talk about that!

Which Futures can be traded on BitMEX?

Now that you’ve got a solid idea on how futures work, let’s look into BitMEX.com and what their available futures are. We will be discussing the available futures markets along with how they are individually quoted, leverage, and trade samples as well. Here is a list of Bitmex Alternatives.

XBT (Bitcoin) Futures

As we all know BTC or XBT is where it all started. The BTC revolution has not only changed the way monetary power is being seen today. Unlike Fiat currencies, BTC and other altcoins can now be used to pay for goods and services anonymously.

As we all know BTC or XBT is where it all started. The BTC revolution has not only changed the way monetary power is being seen today. Unlike Fiat currencies, BTC and other altcoins can now be used to pay for goods and services anonymously.

Bitcoin at BitMEX.com can be traded in perpetual contracts (which we will be discussing shortly later on this article); this means that the contract does not have an expiry date, unlike a regular futures contract. What’s amazing about XBT futures contracts at BitMEX.com is that they offer up to 100:1 leverage! Which is probably the highest leverage being offered today in the market? Here is more on Bitmex Futures Trading.

ADA (Cardano) Futures

Cardano is more than just a cryptocurrency as it is a platform designed to carry out financial applications currently being used by governments and individuals.

Cardano is more than just a cryptocurrency as it is a platform designed to carry out financial applications currently being used by governments and individuals.

At BitMEX.com traders will be able to trade ADA in the form of a Futures Contract which allows the trader to “place bets” on the value of Cardano against BTC on the exchange for a future date. What’s amazing is that the website focuses on BTC alone which means that you do not need to have ADA under your account in order to purchase ADA futures.

ADA Futures are quoted in BTC margin and P&L calculations are also denominated in BTC. To get XBT contract value the trader needs to follow this formula: Multiplier * Futures Price * 1 ADA. The USD contract value can be calculated by XBT Contract Value * XBTUSD. For the profit and loss calculation traders need to have the number of contracts * multiplier (1) * (exit price – entry price).

(The formulas mentioned above can be used for all the futures contracts at BitMEX.com)

Just like the other available coins that can be traded at BitMEX.com, leverage is not as high as BTC and as for ADA leverage only goes up to 20:1 which is at a decent standpoint. If traders purchase 20 BTC worth of contracts then they will only require 1 BTC for the initial margin. Trade sample can be seen here.

EOS Futures

The EOS.IO was designed for the blockchain to be enabled for vertical and horizontal scaling made specifically for decentralized applications. The team behind this amazing project created a structure (much like an operating system) wherein applications can be built.

The EOS.IO was designed for the blockchain to be enabled for vertical and horizontal scaling made specifically for decentralized applications. The team behind this amazing project created a structure (much like an operating system) wherein applications can be built.

The EOS software then provides everything from accounts, databases, authentication, communication and the coordination of all the applications (inside the blockchain) of clusters or CPU’s. This then results in faster transactions that can handle millions within just a second, which is perfect for decentralized applications.

At BitMEX.com, traders will be able to trade EOS as a derivative and come in the form of futures contracts. This, of course, allows the traders to speculate the future price of the EOS token against XBT; for their exchange rate. Leverage for EOS futures contracts goes up to 20:1 just like other coins mentioned earlier.

ETH (Ethereum) Futures

Ethereum is a public blockchain and operating system that features smart contracts and was released way back in 2015. Since then it has garnered a good amount of followers and has created a solid community that uses the currency for different online transactions. The idea behind this project is actually awesome since they focus on smart contracts which run exactly as they are programmed; drastically cutting downtime, censorship, fraud or any other interference like a third party program.

Ethereum is a public blockchain and operating system that features smart contracts and was released way back in 2015. Since then it has garnered a good amount of followers and has created a solid community that uses the currency for different online transactions. The idea behind this project is actually awesome since they focus on smart contracts which run exactly as they are programmed; drastically cutting downtime, censorship, fraud or any other interference like a third party program.

BitMEX.com traders will be able to access two types of derivatives. The first type is ETH/XBT futures contracts and the second is ETH/USD perpetual contracts. Please be advised that even though the perpetual contracts go with USD, traders will only be able to trade XBT for all the available contracts on the website.

This means that even if the trader speculates an ETH/USD price, they will still be paying for XBT and earning XBT at the same time; not ETH or USD.

LTC (Litecoin) Futures

Just like XBT (BTC), Litecoin was designed to be a peer to peer currency that supports very fast transactions at cheap costs than any fiat paying network we have today. Being decentralized, which means that no government is in control of, the transactions work faster, goes through geographical obstacles without any issues or delay. The initial release was about 7 years ago (2011) and works with the available BTC blockchain.

Just like XBT (BTC), Litecoin was designed to be a peer to peer currency that supports very fast transactions at cheap costs than any fiat paying network we have today. Being decentralized, which means that no government is in control of, the transactions work faster, goes through geographical obstacles without any issues or delay. The initial release was about 7 years ago (2011) and works with the available BTC blockchain.

The coin price today in USD is dwarfed by titans like BTC but this doesn’t mean that this is not a popular coin to invest in. At BitMEX.com, traders will be able to bet on the ups and downs of the coin through their futures contracts.

Compared to the other mentioned coins above, LTC leverage at BitMEX goes up to 33:1 which is on the mid-range of futures margin trading. If you want to calculate the contract you simply need to put these numbers into mind:

The multiplier is at 1 and to get the XBT contract value you just need to multiply the multiplier against the futures price * 1 LTC. To get the USD contract value: XBT contract value * XBTUSD; to calculate the P&L you need to have the number of contracts * multiplier (1) * (Exit Price – Entry Price).

TRX (TRON) Futures

TRON is registered in Beijing but has offices in San Francisco as well. Tronix or TRX which is the official currency of TRON is a decentralized entertainment sharing platform that uses the blockchain network technology. TRX rank in the exchange market isn’t that high but they do have an army of loyal users and a community that aims to make their coin one of the best out there today.

TRON is registered in Beijing but has offices in San Francisco as well. Tronix or TRX which is the official currency of TRON is a decentralized entertainment sharing platform that uses the blockchain network technology. TRX rank in the exchange market isn’t that high but they do have an army of loyal users and a community that aims to make their coin one of the best out there today.

It would be interesting to see where their platform would be five years from now; but as of this moment, traders will be able to speculate the rise and fall of their currency and make money out of that.

This can be done at BitMEX.com with the available futures market for TRX/XBT. The available margin for traders is up to 20:1 which is not bad and goes with the majority of the available altcoins on this website.

XRP (Ripple) Futures

Originally released in 2012, XRP is something far different from BTC. Unlike BTC wherein the market is focused on P2P transactions, Ripple, on the other hand, works generally different since they specialize in moving huge amounts of money over the globe within seconds of the transaction being finalized.

Originally released in 2012, XRP is something far different from BTC. Unlike BTC wherein the market is focused on P2P transactions, Ripple, on the other hand, works generally different since they specialize in moving huge amounts of money over the globe within seconds of the transaction being finalized.

Ripple is made for banks, as opposed to Bitcoin which is made to cut out banks of money transfers between people. Ripple aims to enhance the transfer-power of banks and institutions. Unlike BTC, ETH, LTC wherein they can be mined, all XRP tokens were earned giving the company that owns them and can spread them to their liking.

The tokens can only be bought, just like stocks and bonds and they are used for the actual transfer process and issued at its inception. However, banks even get them for free – which is likely the only way to make banks use them. Because: Why should banks pay a new private company for such tokens and not just create a similar project themselves which cuts out the Ripple company?

Traders will be able to purchase XRP futures contracts at BitMEX with a leverage of 20:1; just like the ones mentioned earlier.

BCH (Bitcoin Cash) Futures

BCH / Bcash is an altcoin coming from a Bitcoin blockchain hard fork in Summer 2017. The Bitcoin clone differs from the original Bitcoin in a couple of important points: BCH is more centralized since it is mainly mined by one company. BCH has a way larger blocksize than Bitcoin. So the coin’s centralization will even increase in the future due to its extremely cumbersome blockchain meaning that full nodes will only be loadable and storable by large enterprises.

BCH / Bcash is an altcoin coming from a Bitcoin blockchain hard fork in Summer 2017. The Bitcoin clone differs from the original Bitcoin in a couple of important points: BCH is more centralized since it is mainly mined by one company. BCH has a way larger blocksize than Bitcoin. So the coin’s centralization will even increase in the future due to its extremely cumbersome blockchain meaning that full nodes will only be loadable and storable by large enterprises.

The creators of BCH aimed a Bitcoin version which is more scalable than the original BTC but failed miserably. Short term the transaction fees are lower, why many people without background knowledge think it might be the better Bitcoin, but long term the BCH blockchain will not be managable as it is designed today. Therefore traders should be careful regarding BCH investments.

At BitMEX.com, traders will be able to speculate the value of BCH in the future; and just like the previously mentioned coin, you do not need to have BCH in your hands in order to trade BCH futures. The website also provides 20:1 leverage for BCH futures contracts just like the mentioned coin above. This means that for every contract of 40 BTC you are required to have 2 BTC for initial margin.

Bitmex offers so many features and options that the well informed trader knows how to use to his / her advantage – for others, Bitmex is just gambling.

For constant automated trading activities many professional day traders use a virtual private server to let their trading system run without interruption and with a fast and stable connection. Learn more about how that works.

BitMEX Futures Mechanics

Now that we’ve talked about the available futures contracts you will be able to access at BitMEX.com, it’s time to talk about the trading in general. To start off, below are important mechanics of futures markets available at BitMEX:

- Multiplier – You need to know how much the contract is worth for you to be able to use the provided formula mentioned earlier in this article. The contract information can be seen under contract specifications for each instrument.

- Position Marking – This is how futures contracts are being marked according to the Fair Price Marking method which can be read more about here. This helps the trader calculate the unrealized PnL and the liquidations.

- Settlement – This determines when the futures contracts expire. It is really important to know when your contract expires to easily formulate a game plan depending on how much you want to invest in the position.

- Initial and Maintenance Margin – This is how much leverage a trader can obtain with the chosen instrument along with the point of liquidation.

- Basis – Basis basically refers to what premium or if it has a discount when being compared to the usual underlying spot price and is quoted by an annualized percentage. This exists to give futures an “anchor price” for traders to have.

More here – Bitmex Futures explained.

Here’s a video showing how to trade futures on BitMEX.com (from Crypto Hustle) on YouTube.

Perpetual Contracts

Aside from the regular futures contracts that traders will be able to access at BitMEX.com, they are also able to manage their trades or choose a somewhat “different” path with perpetual contracts. What’s amazing about perpetual contracts is that a trader sets a price for a future date but without the expiration of regular futures contracts.

This means that the trader will be able to stretch it out more and see if how much they will be able to profit from the position. Please be advised that not all exchange/trading websites always offer perpetual contracts, there are only a few that support this feature and BitMEX.com is one of those websites.

Deposits/Withdrawals and Fees

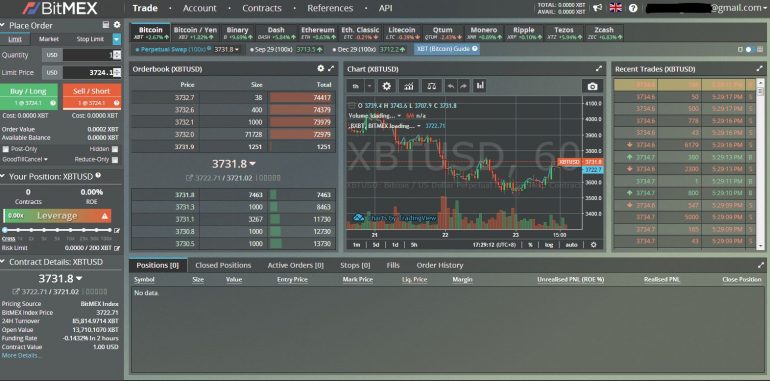

Now that we’ve taken a look at how to create an account and trade using their web trading platform, it is time to know how to put money into our accounts. In order to deposit Bitcoin, all you need to do is click on the “Account” tab which can be found on the upper part of your home screen. The minimum deposit is 0.001 XBT. When it comes to withdrawals, you need to pay about 0.0002 XBT fee. Please be advised that there is no limit on withdrawals.

Of course, there would always be fees involved when it comes to online trading. Most of these fees are not within the deposit and withdrawal methods as this scare people away. Here at BitMex.com, their fees are included in the services they provide. For ZEC the Maker’s Fee is 0%, Takers Fee is 0.25%, Settlement Fee is 0.25%. For all other coins, the Makers Fee is 0.025%, Takers Fee is 0.075%, and the Settlement fee is 0.050%. You can read more about their fees through this link.

You can save 10% on their trading fees when you use the bitmex discount link on this website.

Customer Support

Good to know that BitMex.com is not a stranger when it comes to providing more than just one customer service channel for customers to use. What I hate about some of the online trading platforms today is the fact that they do not have that many channels to use if something goes wrong with your account. Here they have a 24/7 support on multiple channels. You can contact them through email, a support ticket, or through their Social Media channels, which is great since all the drama can be spilled out on a Social Media account. You can read more about their available support here.

They do however have an FAQ section which you are also able to take a look at. Through their FAQ section they are able to answer basic questions like “Is there a fee to deposit Bitcoin?” and a lot more.

Pros and Cons

Pros

- Futures and Derivates

- A lot of features

- Good Options

Cons

- Not for beginners

- Requires KYC (Know your Customer)

- Platform is “laggy” due to all information

- High Withdrawal Fees (0.001 BTC)

- Unregulated

- No Demo Account